The premier real estate market of Mumbai has given a stellar performance despite rise in interest rates, with the month of August turning out to be a best in a decade with property sales registrations recording a 20% YoY growth.

According to Knight Frank India report , Mumbai City (BMC area) saw property sale registrations of 8,149 units in August 2022, contributing over INR 620 Crores to the state revenues.. As much as 60% of all registrations in August 2022 were in the price band of over INR 1 Crore while in terms of apartment size ,homes between the size of 500-1000 sq ft were the most preferred in this month. The state revenues from property registrations grew 47% year on year (YoY) to be recorded at INR 620 Core in August 2022.

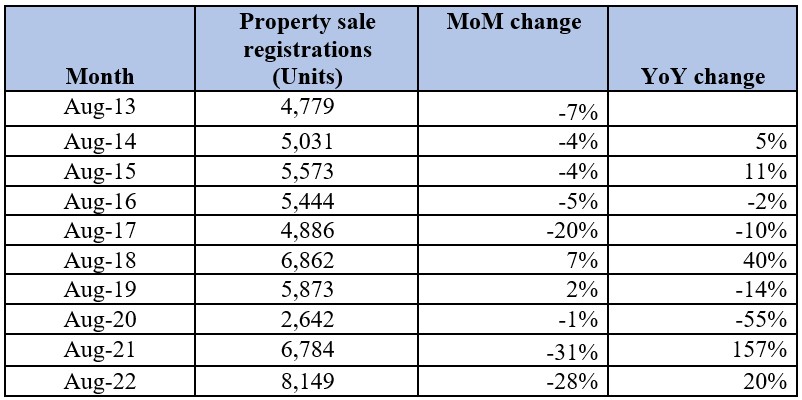

Property sales registration recorded a 20% rise Year-on-Year (YoY) in August 2022. However it was a f 28% MoM drop mostly due to the strong property sales registrations in July 2022. The month of August traditionally records a MoM drop in property registrations. However, August 2022 was the best performing August month in the last 10 years. In the last 10 years, 8 out of the 10 August months have recorded a MoM drop in property registrations, August 2018 and 2019 remain an exception to this, recording a MoM rise of 7% and 2% respectively.

According to Shishir Baijal, Chairman & Managing Director, Knight Frank India, the rise in Repo rate of 140 bps, leading to a rise in home loan rates, and the increase in stamp duty has had its impact on buyer sentiments. Despite that, Mumbai’s home sales momentum has remained comparatively buoyant and recorded a 20% growth over same period last year. It may hence be too early to assess if the impacts of these rate changes on housing sales are long term. Further, homebuyer sentiments are expected to sustain in the upcoming festive season.”

Mumbai city property sale registrations for the month of August

Source: Maharashtra Govt- Dept. of Registrations and Stamps (IGR); Knight Frank India Research

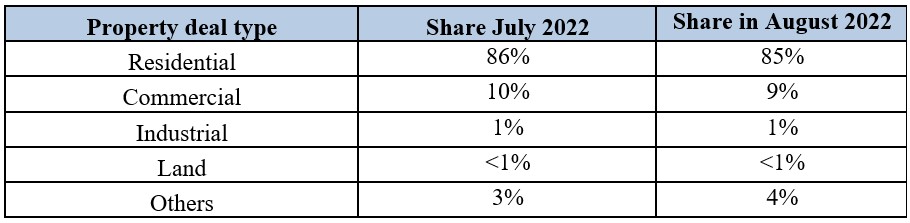

Ninety five percent of all property sales registrations in August 2022 were for properties transacted in the same month. About 3% of properties registered in August 2022 were filed in July 2022 and around 2% of these deals were filed in March and June 2022. Out of all the properties registered in August 2022, 85% were residential deals as compared to 86% in the previous month, while commercial property deals contribution has gone down from 10% last month to 9%. Industrial property deals contributed to 1% while land deals registerations stayed under 1%. Other forms of property deals contributed to 4% of the total deals registered in August 2022.

Typology of property deals in August 2022

Source: Maharashtra Govt- Dept. of Registrations and Stamps (IGR); Knight Frank India Research

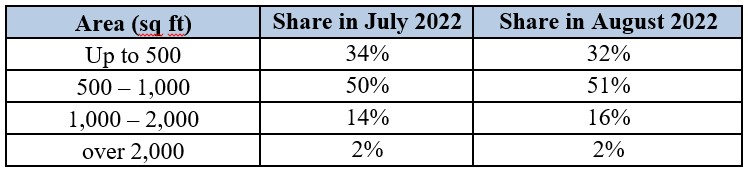

Spotlight on 500 – 1,000 sq ft area segment

The share of homes ranging from 500-1,000 sqft account for more than half the residential properties registered in August 2022. The share rose from 50% in July 2022 to 51% in August 2022. Compact homes continue to be the second preference with a share take up of 32% in August 2022. Homes ranging from 1,000-2,000 sq ft saw a share take up of 16% while the share of over 2,000 sqft homes remained unchanged in August 2022 at 2%.

Area-wise breakup of apartment sales

Source: Maharashtra Govt- Dept. of Registrations and Stamps (IGR); Knight Frank India Research

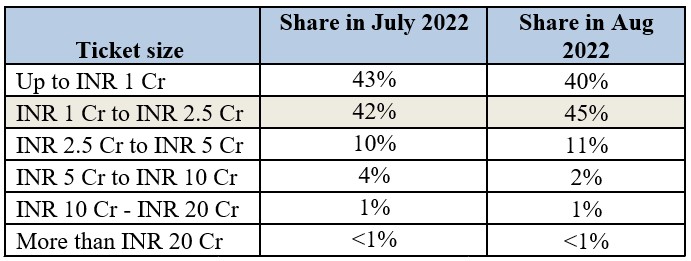

Focus shifts to 1 cr -2.5 cr segment, bagging a share of 45%

Homebuyers’ focus has shifted to residential properties in INR 1 Cr to INR 2.5 Cr segment with the rise in take up from 42% in July 2022 to 45% in August 2022. Properties with a ticket size of INR 1 Cr and below declined from 43% in July 2022 to 40% in August 2022. Share take up in INR 2.5 Cr to INR 5 Cr segment has increased from 10% to 11%.

Ticket size wise split of property sale registrations

Source: Maharashtra Govt- Dept. of Registrations and Stamps (IGR); Knight Frank India Research

Western Suburb and Central Suburb account for 93% of the total market

Western suburbs’ share in total registrations in August 2022 has risen from 56% in July 2022 to 57% in August 2022. Central suburbs have recorded a rise in share from 28% in July 2022 to 35% in August 2022. Central and South Mumbai saw a decline MoM, with a drop in property registrations from 8% to 3% in the case of Central Mumbai and 8% to 4% in the case of South Mumbai.

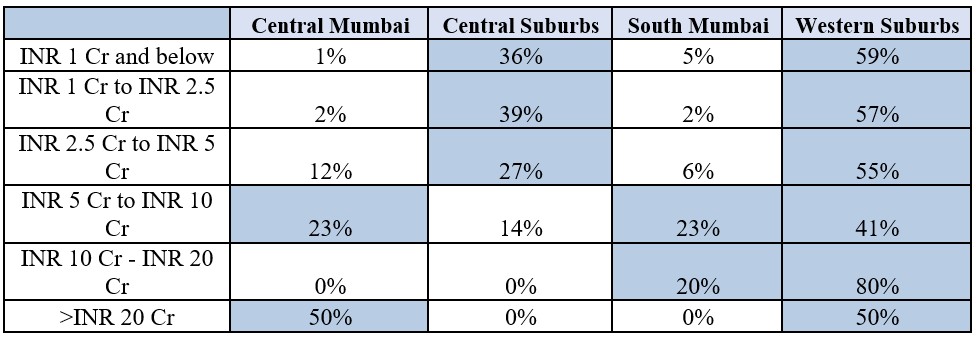

Maximum share of property registrations in the ticket size of INR 5 Cr and below, has been recorded in the Western and Central suburbs. For high value ticket sizes of INR 5 Cr and above, Central and South Mumbai recorded the larger share contribution. Western suburbs have emerged as a market catering to the housing needs of all income groups.

Micro-Market and Ticket size wise breakup of apartment sales

Source: Maharashtra Govt- Dept. of Registrations and Stamps (IGR); Knight Frank India Research

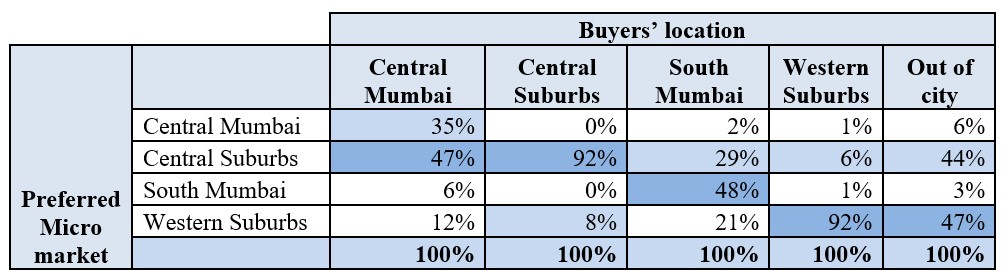

Majority buyers do not prefer relocation outside their micro markets

The consumers continue to prefer to remain in their home micro market. Buyers in Central and Western suburbs have shown a strong tendency to upgrade properties within their own micro market. As many as 92% of homebuyers from Central and Western suburbs prefer their current micro market while purchasing property. About 6% of all home buyers in Western suburbs have relocated to Central suburbs while about 8% of homebuyers from Central suburbs have relocated to Western suburbs.

Homebuyers from the prime micro markets like Central and South Mumbai have lower inclination towards property purchase within the micro market. As many as 47% of home buyers from Central Mumbai and 48% of home buyers from South Mumbai have purchased a home in the same micro market. The Central suburbs have emerged as the next preferred market for homebuyers of South Mumbai having a share contribution of 29%.

Out-of-city buyers have shown interest in purchasing residential properties primarily in Western suburbs followed by Central suburbs.

Preferred location of Property purchase

Source: Maharashtra Govt- Dept. of Registrations and Stamps (IGR); Knight Frank India Research

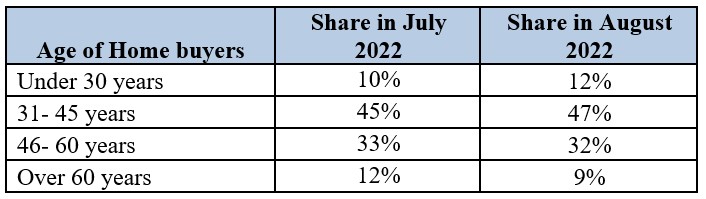

Home buyers in the 31-45 years age bracket top the chart

The largest share of home buyers are in the 31- 45 years of age category having a contribution of 47% of the total residential property registrations. Buyers in the age group 46 -60 years have a share of 32%, while 12% home buyers are under 30 and 9% are over 60.

Age of Home buyers

Source: Maharashtra Govt- Dept. of Registrations and Stamps (IGR); Knight Frank India Research

Government revenue collection saw a 47% YOY rise

The state government earned a revenue of INR 620 Cr, surpassing August 2021’s collection of INR 421 Cr on account of higher property registration volume, increased contribution from higher value segment and one percentage point higher stamp duty rate. Even though the property sale registrations grew by just 20% YoY, the government revenue collection went up by 47% YoY.

1

2

3

4

5

6