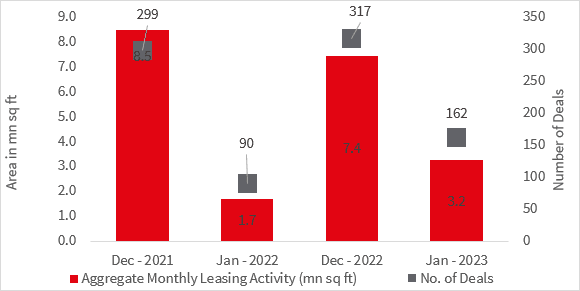

Though the opening month of the year 2023 started on a tepid note for commercial office leasing after the momentum seen in 2022, yet it has seen over 90% year-on-year increase in leasing. In the first month of the new year, Delhi-NCR, Chennai, and Mumbai have emerged as the major drivers of office leasing in the country.

According to a recent JLL report, the total monthly leasing activity for the month of January stood at 3.2 million sq. ft with the typical January lull, post the 2022 year-end leasing momentum, causing a 56.4% Month -on-Month (M-o-M) decline. However, it was still higher by 93.1% Year-on-year (Y-o-Y). Fresh leasing which included expansion and relocation-driven space take-up accounted for 87% of all recorded transactions during the month. The month of January is typically a slow period, as the holiday season for global corporates and future business planning take precedence. Mostly deals that slipped due to certain reasons get concluded during this month.

In January 2023, the top three cities in that order were Delhi NCR, Chennai, and Mumbai, accounting for 77% of monthly leasing activity. In terms of a number of transactions, Mumbai remained the most active market, followed by Delhi-NCR.

The aggregate leasing activity in January was sluggish but on expected lines as this period coincides with the festive/holiday season and future business plans being put together with only spillover deals largely getting executed during this period. As future business projections are made under the shadow of global headwinds and the tech sector, faces a period of course correction, there is a likelihood of slow take-up. JLL expects that rising office occupancies and growth in other occupier segments should keep the momentum steady. However, an overall sluggishness is likely but more sustained trends of demand movement will be visible, over the course of the next 2-3 months,” said, Dr. Samantak Das, Chief Economist and Head of Research and REIS, India, JLL.

The IT sector is presently facing slower employment and sluggish corporate growth expectations, and as a result, space take-up may be more benign as part of a course correction. Given the evolving global economic scenario, other occupier categories are anticipated to maintain a steady state, although with a minor downward bias in the short term. The IT/ITeS category still remained the largest driver of overall market activity in January, accounting for 28% of total market activity, thanks to one large transaction and a few smaller ones. Whilst the actual numbers were identical m-o-m, BFSI and manufacturing made considerable advances in terms of share.

1

2

3

4

5

6