As the cost of raw materials like cement and steel, has gone up by over 20 percent you in March 2022,this threatens to breach the housing affordability. And it is not a good sign for the residential realty which saddled by huge unsold inventory, is still recovering from the onslaught of covid pandemic.

Over the last one year, developers’ average cost of construction has risen 10-12%, owing to higher input cost due to supply-side constraints. This surge in cost comes at a time when developers have been under pressure due to higher debt and liquidity concerns over the last few years.

The cost of key materials like cement and steel have risen over 20% yearly as of March 2022. These constitute a predominant share in the total cost of construction.

Escalation in key input cost

Note: Costing for steel, cement, copper and aluminum is based on dealer-level cost as per Colliers’ internal costing framework; Overall values are exclusive of GST

So far, the developers have been refraining from increasing prices as the market is still recovering from the onslaught of covid pandemic. Moreover, they have been facing pressure due to high debt and liquidity pressure. But with rising material cost, developers will be compelled to increase prices as construction materials account for about two third share in the total cost of construction. According to Ramesh Nair, CEO India & Managing Director, Market Development Asia, developers have already been operating on thin margins over the last few years. The rising cost will impact developers in the affordable and mid-market segments relatively more as they are already operating on lower margins. With wholesale price inflation (WPI) and material cost, both seeing a double-digit rise, the cost of construction can rise by a further 8-9% by December 2022.

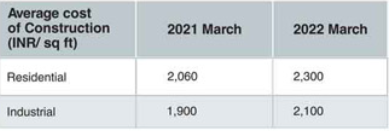

YoY change in average cost of construction

Note: These are average cost excluding GST at an all-India level in INR per sf. Values are for a standard Grade A residential building of 15 floors and for a standard pre-engineered Grade A industrial building.

Source: Colliers

Residential projects in the affordable and mid-income segments carry relatively lower margins and are price sensitive. Hence, any major increase in input cost can put pressure on developers to pass it on to end-users. On the other hand, Grade A industrial and warehousing facilities are already seeing robust demand from E-commerce players. Increase in construction cost is likely to put an upward pressure on rents due to limited availability of quality assets.

According to Argenio Antao, COO, Colliers India, developers are facing high cost but are being cautious to increase the price for end users as it might impact overall demand. However, if the escalated cost persists, developers may have to pass on increased overheads to the end users. Some intervention from the government in the form of lower import duty can provide some relief to developers, especially in segments with low margins.

Overall, in the market, large Grade A developers will be able to withstand the rise in cost and may pass it on depending on the demand dynamics. However, smaller developers may seek to enter joint development agreements for specific projects to tide through the high cost. Meanwhile Mumbai realtors are set to raise home prices from April. According to developers body- MCHI- CREDAI, housing prices could go up by 10-15 percent, due to increase of Rs 400-600 per square ft in construction costs with rising inflation in commodities like steel, cement and others. The rise in raw materials cost has led to cumulative rise of 15 percent in construction costs, making the ongoing projects financially unviable at the current sale values. In Mumbai alone the cost increase will impact MCGM approved 2773 projects and 2,60000 units over the next three years.

1

2

3

4

5

6