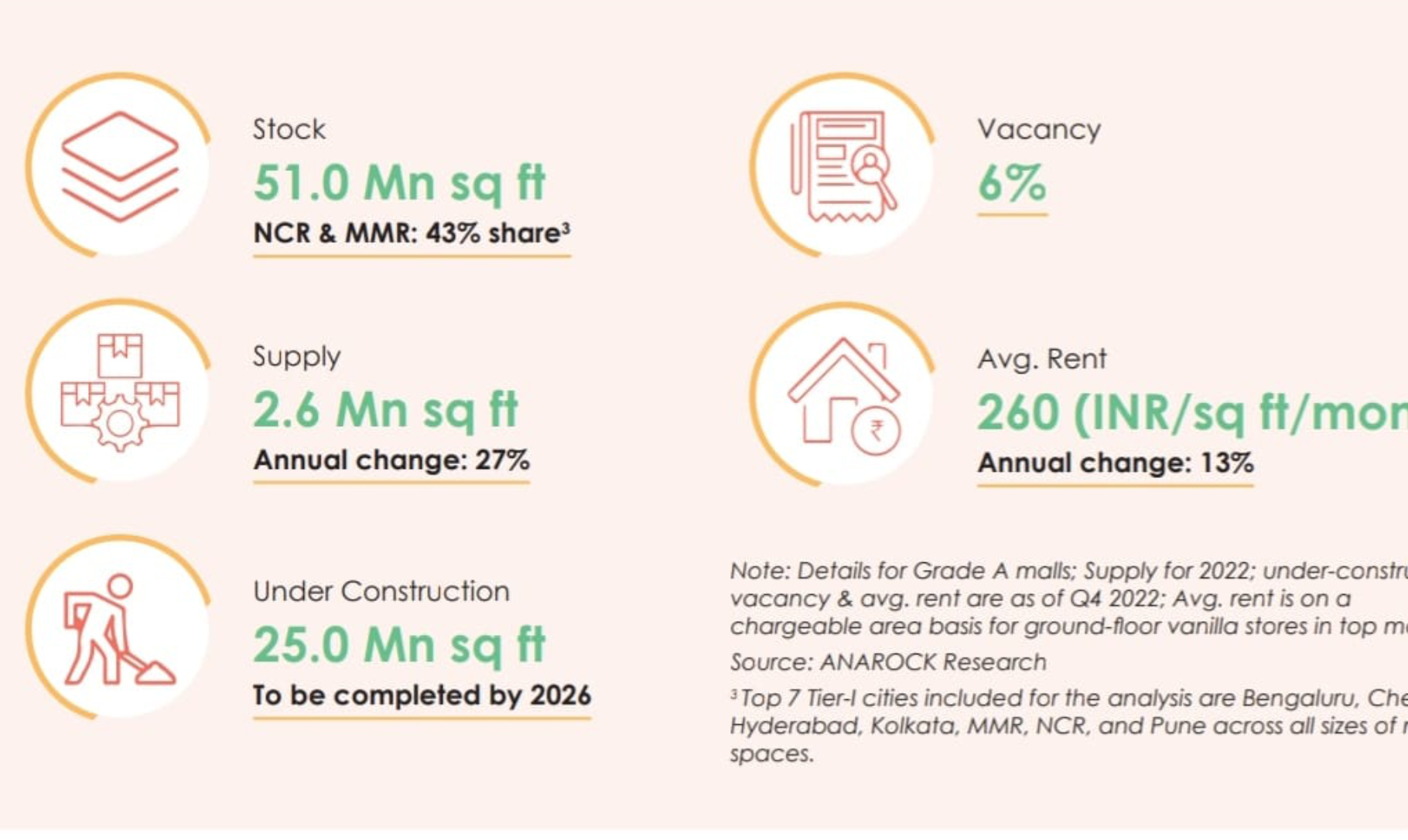

Retail real estate staged a big comeback in 2022 with the top 7 cities adding 2.6 million sq ft of mall space, registering 27 percent increase against 2021. Going forward, shopping mall space is set to maintain momentum with 25 million sq ft likely to be added in top 7 cities in the next five years.

Driven largely by rising consumption, the rebound in the Indian retail market has been exemplary in 2022 which is favorably impacting retail real estate across the country, according to a joint report by real estate consultants Anarock and Retailers Association of India (RAI). Buoyed by the growth, developers now plan to add nearly 25 Mn sq ft of new mall space across the Top 7 cities over the next 4-5 years, with NCR and Hyderabad accounting for nearly 46% of the total new upcoming supply, closely followed by Bengaluru at 19%.

Back in 2022, the top 7 cities added over 2.6 Mn sq ft of mall space which was 27% more than the preceding year -2021.“The festive season, devoid of restrictions and any fear of the contagion, was exemplary with record high volumes and sales value,” says Anuj Kejriwal, CEO & Managing Director – ANAROCK Retail. Sales value estimated during the festive season in late 2022 was Rs 2.5 lakh Crore, nearly 2.5 times compared to the previous year. The revival of consumer sentiments and penchant for consumption is therefore being promptly acted upon by the majority of brands, retailers, and mall developers. The new planned mall supply across the top 7 cities is testimony to the developers’ expansion strategy… Further, the retail market size is expected to touch USD 2 Trillion by 2032, growing from USD 690 billion in 2021, facilitating the organized retail sector to grow at 25% CAGR.

According to Kumar Rajagopalan, CEO, of the Retailers Association of India (RAI), the Indian retail sector attracted around USD 1,473 Mn between 2019 and 2022, of which 76% of total investments came in 2019 itself. Among the cities, Hyderabad and MMR accounted for nearly 40% of the total PE investments in the sector. Data further indicate that back in 2022, the top 7 cities added nearly 2.6 million sq ft of mall space during 2022, which increased by 27% over the previous year -2021. Among the cities, Bengaluru and Hyderabad were the only cities which saw new mall supply addition during 2022. Presently, the top cities have over 51 million sq ft of mall stock across the country with NCR, MMR, and Bengaluru accounting for 62% of the total stock.

The rental growth of mall space is quite creditworthy. The average. rentals in malls, appreciated by nearly 15% in 2022 over the previous year, thus reaching higher than the pre-pandemic levels. Bengaluru registered the highest uptick in rentals of around 27%, followed by Kolkata at 20% in 2022 over the previous year.

EVENTS

Annual Affordable Housing Conference

9 March 2023, London

Mipim 2023

14-17 March 2023, Cannes, France

NAR India Convention 2023

18-19 March 2023, Coimbatore

Property Expo Bangalore

18-19 March 2023, Bangalore

Moscow International Property Show

7-8 April 2023, Moscow

Ficci Real Estate Summit

21 March 2023, New Delhi

DCD Management & Operations

22-23 March 2023, Online

International Real Estate Expo

14 April 2023, Mumbai

The Prop Investor Show 2023

21-22 April 2023, London

GRI Logistics & warehousing India

26 April 2023, Mumbai

K.P Singh, Chairman, DLF

Smart cities are not the answer. The focus should change from retrofitting through smart cities to building new cities.

Sanjay Dutt, MD & CEO, Tata Realty & Infrastructure

Strong location, designing, positioning, equity base, track record, and organization strength can mitigate the risks like costly finance

Jairam Sridharan , MD, Piramal Housing & Capital Finance

Becoming a bank will depend on regulatory intent on NBFCs. But it is more stable and sustainable to have a banking business model.

Krishnan Sitaraman, Senior Director, Crisil Ratings

While NBFC assets will grow to double-digit levels in the medium term, their balance sheets may not grow to the extent on account of the asset-light strategy that a number of NBFCs plan to follow.

Hari Krishna V, MD, Head of Real Estate India, CPP Investments

Over the past few years, we have made numerous investments in India’s industrial space where we see strong demand as the manufacturing sector continues to grow and the e-commerce sector matures. We will further capitalize on these opportunities and believe our investment will deliver strong risk-adjusted returns.

Jonathan Gray, President & COO of Blackstone

India has outstanding fundamentals for long-term growth. We have had remarkable performance over the years here and we believe the best is yet to come.

1

2

3

4

5

6