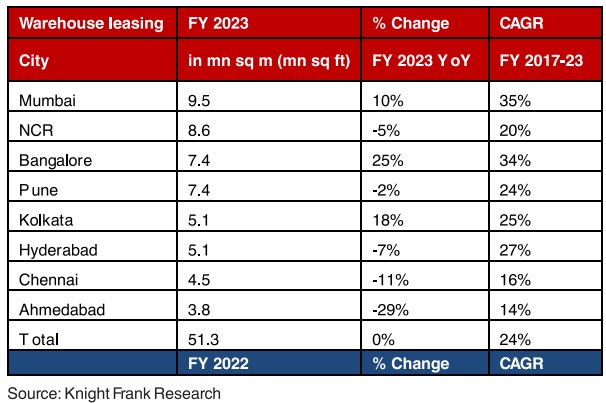

Knight Frank India, Despite a marginal 5 percent YoY dip in warehousing transactions at 8.6 million sq ft in FY23, NCR has maintained healthy leasing volumes, with 3PL segment bagging the highest share of 54 percent .

WAREHOUSING TRANSACTIONS ACROSS TOP 8 INDIAN CITIES

According to Knight Frank, unlike the trends witnessed during the pandemic years from FY 2020 to FY 2022, the third-party logistics (3PL sector garnered the lion’s share of 54% of warehousing leasing volumes in FY 2023. E-commerce sector, on the other hand, witnessed its share shrinking to 8% in FY 2023 due to a slowdown in demand. Demand for new warehousing facilities by e-commerce sector shrunk drastically in FY 2023 post the pandemic. The manufacturing sector as an occupier group saw its share in transaction volume scale up to 18% in FY 2023.

INDUSTRY-SPLIT OF TRANSACTION VOLUME

Notes: Warehousing transactions data includes light manufacturing/assembling

Other Sectors – These include all manufacturing sectors (automobile, electronics, pharmaceutical, etc.) except FMCG and FMCD

Miscellaneous – These include services such as telecom, real estate, document management, agricultural warehousing and publishing

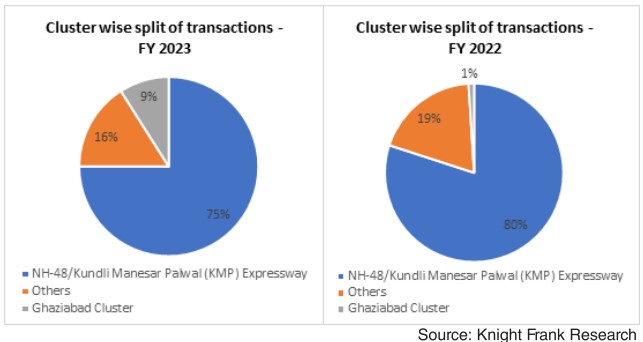

In line with FY 2022, the NH 48/Kundli Manesar Palwal Expressway (KMP) dominated the cluster-split pie of warehousing transactions in FY 2023 accounting for 75% of the total warehousing transaction volume.

Barring NH 48/Kundli Manesar Palwal Expressway (KMP), 16% transactions were spread across other warehousing clusters in NCR such as Sonipat, Ballabgarh, Habibpur and Greater Noida. Ghaziabad cluster’s share in the total warehousing spaces leased increased from 1% in FY 2022 to 9% in FY 2023 largely on the back of warehousing requirements from 3PL, manufacturing and retail occupier groups for locations such as Dadri, Dasna and Sikandarabad.

With large scale infrastructure projects under construction , such as the Delhi-Mumbai Industrial Corridoor (DMIC) connecting Sohna Road, Dedicated Freight Corridor (DFC) connecting Bawal and Haryana to Dadri, and increased land requirements from 3Pl, e-commerce and retail players, the average rents increased 7% YoY in Fy23. demand sustenance coupled with inflationary trends in steel and cement left developers with little choice but to increase rents.

According to Shishir Baijal, Chairman and Managing Director, Knight Frank India, the warehousing market has experienced consistent growth with transaction volumes exceeding the previous year’s highest historic figures. This gowth is not limited to the top 8 markets but has extended to secondary markets, supported by enhanced infra such as highway networks, rail systems and air transportation. The 3PL providers and manufacturing companies have emerged as the leading players indicating their increasing importance in the industry. Flexibility, scalability and customized options are cruxcial to meeting the evolving needs of occupiers.

1

2

3

4

5

6