Institutional investments in Indian real estate sector have touched USD 1.0 billion in the first quarter of 2024, signalling a steady and positive start to the year. While this was a 40 percent drop compared to the same period last year, India’s real estate investments showed improvement on a sequential basis registering 21 percent QoQ rise.

Foreign investments retained their dominance, forming 55 percent of the total inflows during the quarter. Domestic investments too witnessed a notable rise at 15 percent YoY in Q1 2024. The share of domestic inflows in overall institutional investments continued to rise to 45 percent in Q1 2024, compared to 24 percent in Q1 2023. Apart from the core asset classes such as office, institutional investments in industrial & warehousing and residential segments were noteworthy in the first quarter. The segments received capital inflows to the tune of USD 0.2 billion and USD 0.1 billion respectively in Q1 2024, forming a combined 28 percent of the total investments.

“At USD 1 billion, institutional investments into Indian real estate have started on a steady positive note. Interestingly, domestic investors are increasingly gaining more ground in Indian real estate. It is evident in the whopping 45 percent share in Q1 2024 investments, a marked surge from prior years. Within domestic institutional investments, office and residential assets formed about 66 percent, reflecting a strategic approach to align with India’s growth trends. This also underscores growing confidence of diversified spectrum of investors across multiple investment strategies including credit and acquisitions,” said, Piyush Gupta, Managing Director, Capital Markets & Investment Services at Colliers India.

“With IMF’s projected GDP growth rate of 5.7 percent in 2024, India continues to garner significant investor interest within the APAC region. In Q1 2024, the APAC region contributed to over 82 percent of foreign inflows in India’s real estate sector, with investments predominantly focused on office assets followed by industrial & warehousing segment. The surge in investments by APAC countries such as Singapore can be attributed to a combination of factors including favourable investment climate, strong demand fundamentals across core & non-core segments within real estate, and strategic alliances in the form joint venture platforms. Amid evolving global capital trends, India’s real estate market promises significant growth potential and will continue to attract global capital from diverse regions,” says Vimal Nadar, Senior Director and Head of Research, Colliers India.

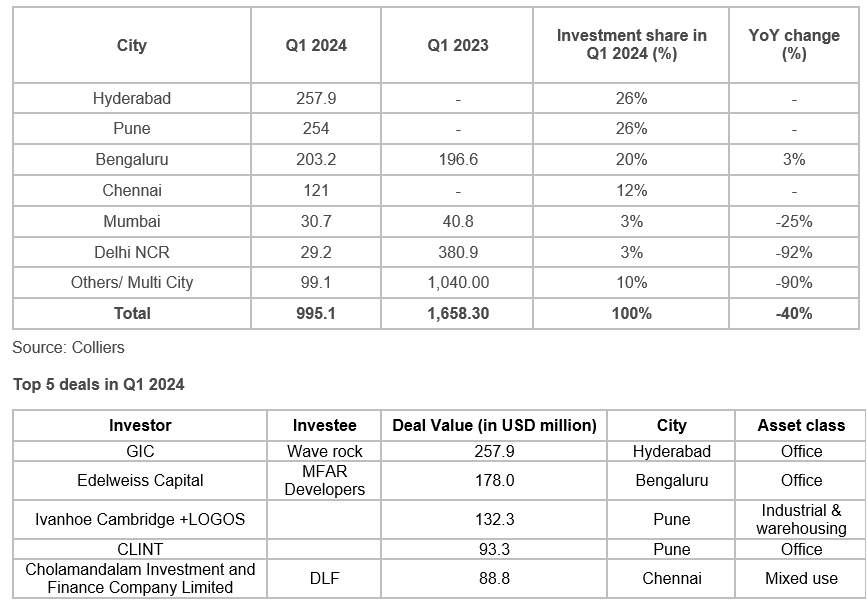

In Q1 2024, Hyderabad and Pune collectively attracted over 50 percent of the investment inflows in India, notably drawing substantial capital into office spaces and industrial & warehousing assets. These cities, alongside Bengaluru, solidified their positions as prime destinations for office sector investments. At the same time, investments in Industrial and warehousing assets were concentrated in Pune, Chennai, and Delhi-NCR, indicating robust industrial activity in these cities.

City-wise Investment Inflows in Q1 2024

Source: Colliers

1

2

3

4

5

6