Despite subdued pre-sales performance in Q1 FY24, Mahindra Lifespaces’ launch pipeline and growth targets remain on track.

According to a report by Motilal Oswal Financial Company (MOFSL) ,Mahindra Lifespaces (MLDL) reported bookings of INR3.5b, 14% above estimated bookings , but down 43% YoY and 4% QoQ due to absence of any major launches. MLDL launched a phase of the plotted development project at Lakewoods, Chennai (0.37msf) at the end of the 1Q24, which received a strong response (71% sold out). However, bookings spilled over to 2QFY24. Leasing in IC&IC segment was subdued as MLDL leased out only 3 acres in 1QFY24 (vs. 52 acres and 42 acres respectively in 4QFY23 and 1QFY23) of land at MWC, Chennai for a total value of INR120m at a realization of INR42m. Additionally, it also received transfer charges of INR20m from MWC Jaipur. The company collected INR2.8b during the quarter and spent INR1.2b on construction. It generated surplus operating cash flows of INR1.3b. Its consolidated net debt (Resi+IC&IC) declined INR0.9b to INR2.1b.The profit & loss (P&L) performance was muted because of lower completions and recognition of low-margin projects. MLDL delivered 0.18msf of area (Bloomsdale, Nagpur) and reported revenue of INR1b, up 4% YoY. EBITDA loss expanded to INR430m and it generated a net loss of INR43m vs. profits in both the comparable quarters.

Roadmap For 5X Growth

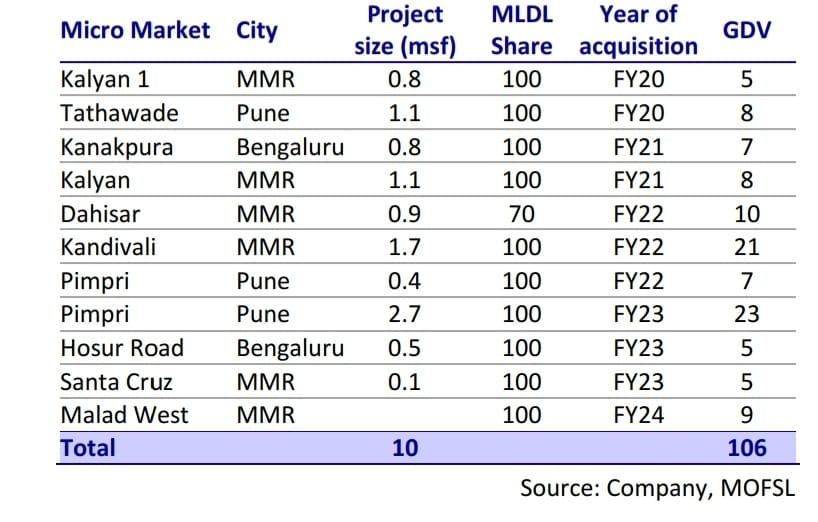

The company management has laid out a growth roadmap where it plans to grow MLDL’s pre-sales (Residential + IC&IC) by five times over the next five years. Bulk of that growth is expected to come from residential business with IC&IC leasing likely to remain stagnant at INR5b.To achieve its growth target, the company is aiming for a project pipeline with revenue potential of INR400-500b over the next four years, of which INR150-160b has already been signed up. This includes 68 acres of land at Thane (INR80b), M&M land at Kandivali and Citadel at Pune.

Overall, the company has segregated its land acquisition strategy across different size categories where it aims to sign 2-3 mega projects with each valued at INR50-80b, 4-5 projects of INR20-50b each, 4-5 projects of INR10-20b each and 15 projects of INR5-10b each.

The company currently has 0.5% share in MMR and aims to raise this share to 5% over the next 4-5 years, leading to a contribution of INR50b. Pune and Bengaluru are expected to contribute INR20-30b each. It is not targeting any other markets beyond MMR, Pune and Bengaluru to achieve this 5x growth.

Highlights of Plans For New Launches

The Kandivali launch is not contingent on Supreme Court’s verdict as the company already has plan B in place. The first phase will be launched by end-2QFY24 having a GDV of INR12b. The second phase of the Pune project will also be launched by 3QFY24 having a GDV of INR7b.Both the recently acquired redevelopment projects will be launched by 4QFY24 and the company is awaiting approvals for the Dahisar project. MLDL has made good progress on the IIPP policy and it expects to launch Thane project over the next 4-6 quarters. The policy mandates 50:50 mix of residential and commercial development with both assets required to be delivered at the same time. As things stand, the overall sales potential is INR80b.

MLDL management continues to target INR5b worth of annual leasing beyond FY25 too. The launch of Pune Park can happen over the next 12 months and at Ahmedabad, search is still on for an anchor tenant. In MWC Jaipur, management is trying to get 570 acres of SEZ land converted into DTA, which could lead to significant value unlocking.

Targets on Track

The FY25 targets of the company are on track with business development momentum resulting in further upside. While 1QFY24 pre-sales performance was subdued, the launch pipeline remains on track for 2HFY24 and hence FY24E/FY25E pre-sales may well be retained. With lower-than-expected delivery at Bloomsdale, Nagpur, FY24E Revenue/ PAT needs to be cut by 11%/13%.

The company is expected to generate INR30b of cash flows from its existing residential pipeline and INR12-15b of surplus cash flows from IC&IC vertical over the next 4-5 years, which should be sufficient for the targeted project additions.

1

2

3

4

5

6