Registering 114464 properties since January 2023, with more than half of registered properties worth Rs 1 crore and above, Mumbai has recorded the best November registrations in more than a decade.

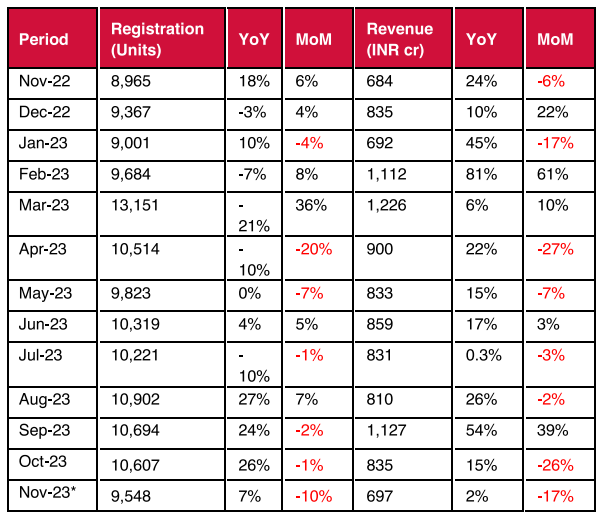

Despite fewer days working days in November due to a slew of holidays, Mumbai city (an area under BMC jurisdiction) is expected to record 9,548 property registrations, contributing to INR 697 Crores to the state government revenues. According to a Knight Frank report, while registrations showed a 7% YoY rise, revenue from stamp duty increased by 2% compared to the preceding year. Of the overall registered properties, residential units constitute 80%, the remaining 20% constitute non-residential assets.

Mumbai property sale registration and government revenue collection

Source: Maharashtra Govt- Dept. of Registrations and Stamps (IGR); Knight Frank India Numbers forecasted based on per day run rate.

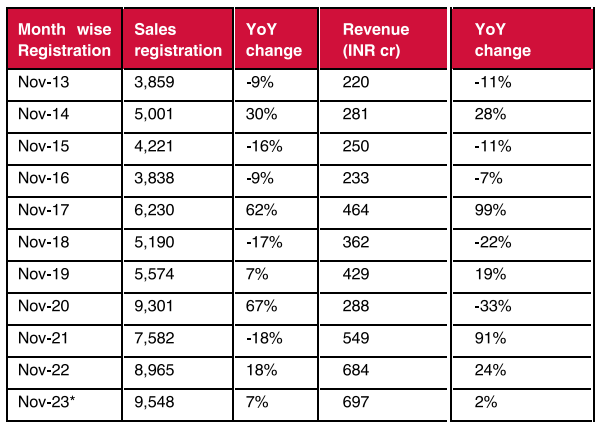

Best November sales registrations in last 11-years (2013-2023)

Source: Maharashtra Govt- Dept. of Registrations and Stamps (IGR); Knight Frank India

Numbers forecasted based on per day run rate.

In November 2023, Mumbai is set to achieve its most successful November in the past 11 years for property registrations, highlighting the enduring strength of the residential real estate sector. This success is driven by factors such as increasing income levels and a positive outlook on homeownership, reflecting the unwavering trust of property purchasers in the city’s real estate market.

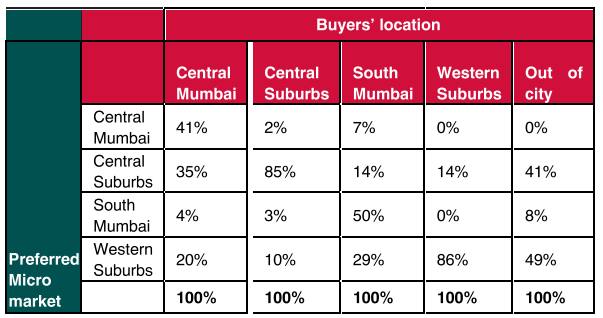

Preferred location of Property purchase in Mumbai

Of the total properties registered, Central and Western suburbs together constituted over 75% as these locations are a hotbed for new launches offering a wide range of modern amenities and good connectivity. 86% of Western suburb buyers and 85% of Central suburb purchasers opt to purchase within their micro market. This choice is influenced by the familiarity of the location, along with the availability of products that align with their pricing and feature preferences.

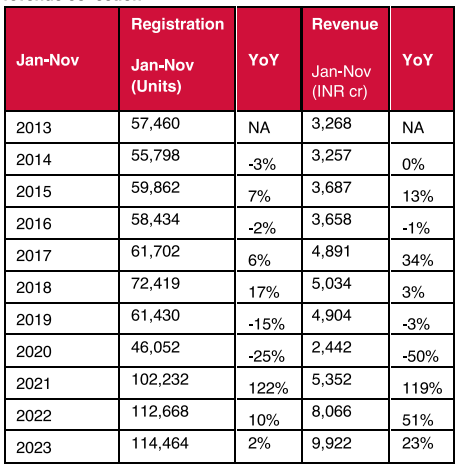

Mumbai property sale registrations and government revenue collection

In the eleven months of 2023, the city achieved a registration count of 114,464 units resulting in a substantial revenue accumulation of INR 9,922 cr for the state treasury. This achievement stands as the highest within the same timeframe since 2013. This surge in property registrations has notably bolstered the government of Maharashtra’s coffers. The elevated revenue growth can be attributed to factors like registration of higher-value properties and augmented stamp duty rate.

Shishir Baijal, Chairman & Managing Director, Knight Frank India, said, “Following a notable 6.5% YoY increase in prime property prices during Q3 2023, Mumbai is anticipated to witness a 5.5% upsurge in prime residential prices in 2024. This surge is primarily attributed to robust housing demand and economic expansion. This enduring trend is amplified by the rising share of high value property registrations of INR 1 crore and above, which has increased from 51% in YTD November 2020 to 57% in YTD November 2023. Having said that, besides the strong sense on home ownership, rising income levels, stable home loan interest rates coupled with moderate rise in property prices have contributed to the cause of affordability in Mumbai, a crucial factor that will help sustain the momentum of housing sales in Mumbai.”

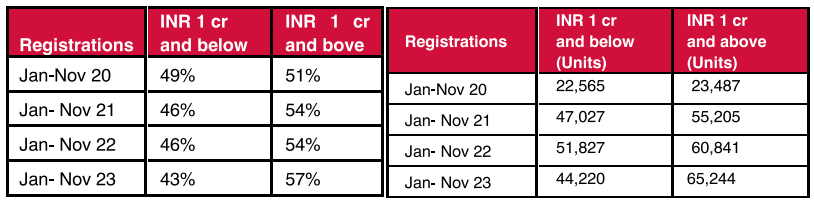

Ticket size wise split of property sale registrations

In recent years, there has been a consistent upward trend in the percentage of registrations for properties valued at INR 1 cr or more. This proportion has risen from 51% in January to November 2020 to approximately 57% in January to November 2023.

The increase in property prices, combined with a significant 250 basis point rise in the policy repo rate during the last two years, has had a negative impact on the registration of properties below the INR 1 cr threshold. However, registrations for properties valued at 1 cr and above have shown a relatively limited impact of these changes.

1

2

3

4

5

6