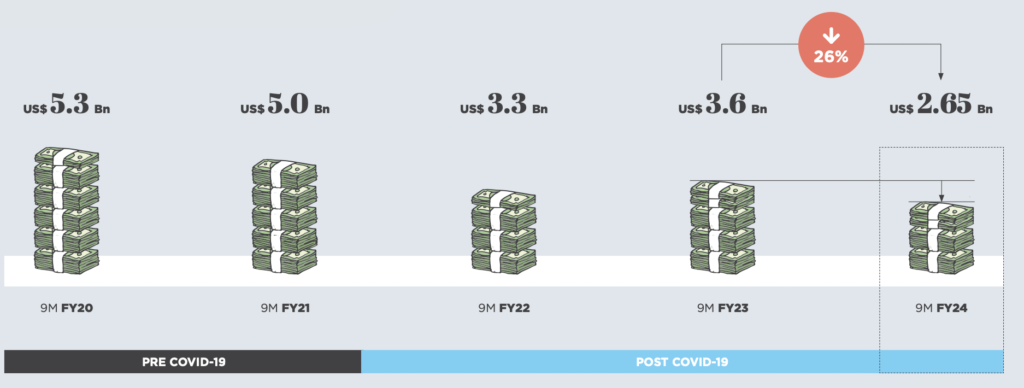

The high cost private equity investments (foreign and domestic) have seen a decline of 26 percent in 9M FY24 due to the residential boom and global geopolitical uncertainties and a high interest rate environment.

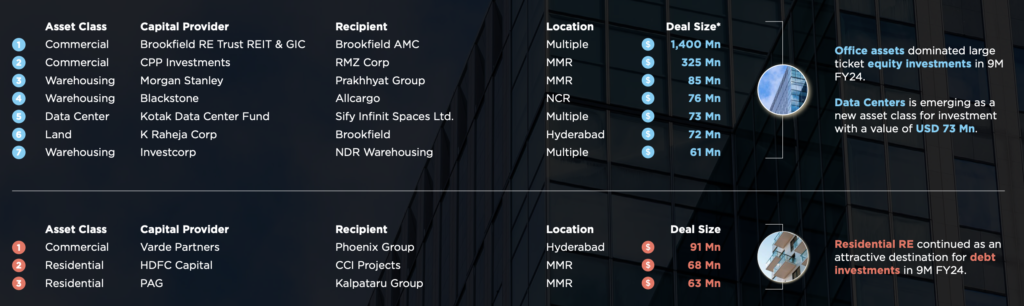

Top 10 PE Deals in 9M FY24

The share of the top 10 deals was 87% of the total value of PE investments in 9M FY24 as compared to 76% in 9M FY23. The average ticket size marginally increased to USD 95 Mn in 9M FY24 from USD 91 Mn in 9M FY23. This is largely due to a large deal in which Brookfield India Real Estate Trust REIT and Singapore’s sovereign wealth fund GIC together acquired two commercial assets – one in Mumbai and the other in Gurugram, NCR, from Brookfield Asset Management with an enterprise value of USD 1.4 Bn.

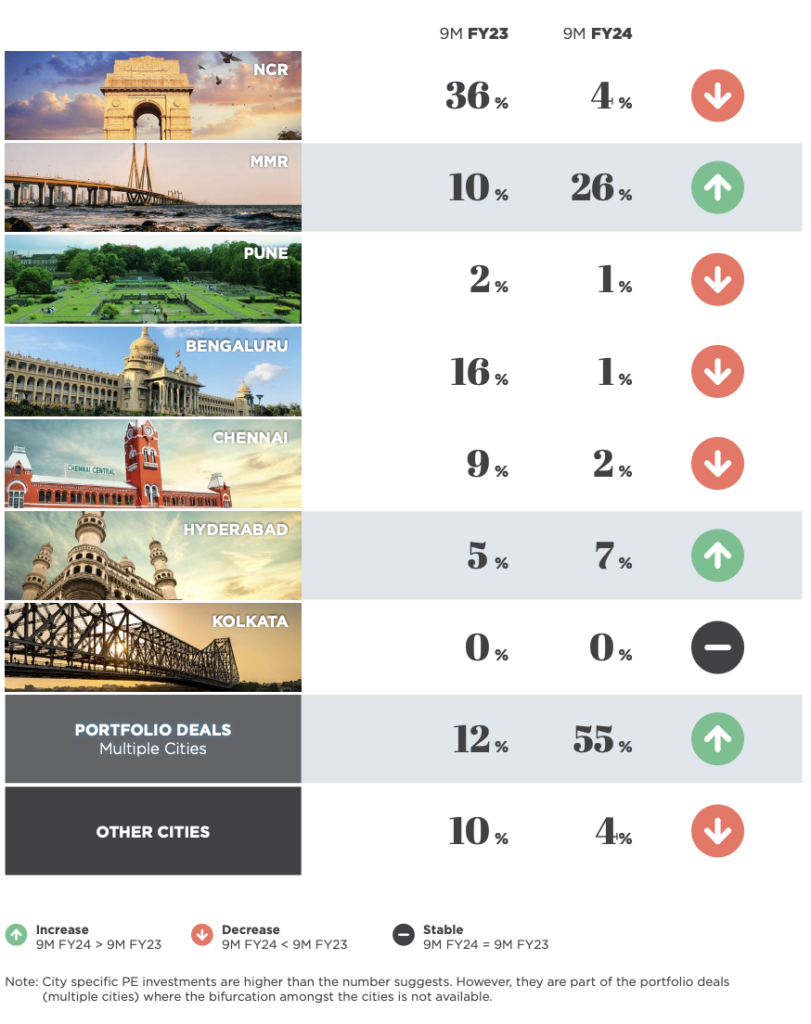

Movement of Capital Inflow

Multi-city transactions increased sharply during 9M FY24, dominated by the Brookfield India REIT & GIC. MMR led the transaction league tables in city-specific transactions, with the region reporting investments of USD 694 Mn in 9M FY24, against USD 375 Mn in 9M FY23. PE investors continue to prefer equity investments with the PE share at a healthy 24 percent.

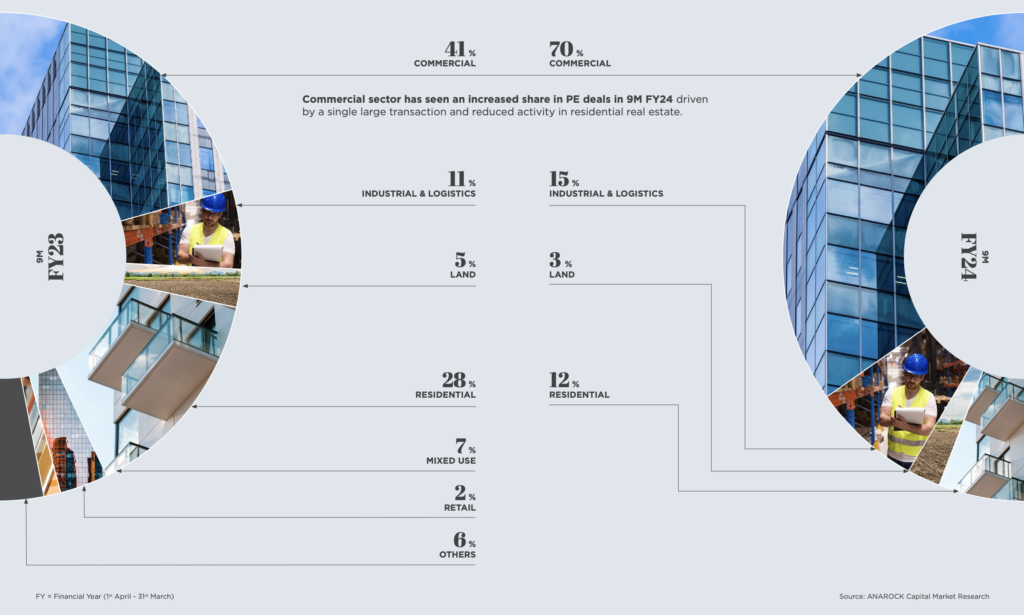

Asset Class-wise Funding

The commercial real estate sector has seen an increased share in PE deals in 9M FY24, driven by a single large transaction and reduced activity in residential real estate.

Key Takeaways

Residential Real Estate

Despite elevated home loan interest rates, the residential real estate sector maintained a robust performance, indicating positive industry sentiment. A significant demand driver is rising rental values across various markets.

There is a notable interest surge in luxury and premium residential projects as homebuyers aspire to transition to more spacious living in vibrant communities, moving away from standalone structures.

A demographic shift in homebuyers is evident, with the age bracket dropping from 40+ to sub-40, with attendant implications on product design and the value offering of housing projects.

The current demand dynamics suggest another strong performance in CY2024.

Commercial Office Real Estate

9M FY24 saw a robust performance in the commercial office space, particularly in the top 6 cities. The sector’s reliance on IT/ITeS has diminished, with manufacturing, BFSI, and coworking contributing to the resilient demand. Growth in the IT/ITES sector is expected as more employees shift to working from offices for 3-4 days a week.

On a quarterly basis, the rental landscape displayed positive momentum, with most micro-markets experiencing increases of 0-5%. Of these, Bengaluru, Mumbai, and Chennai, demonstrated stronger rental growth.

Bengaluru led Pan India supply during the quarter, with notable contributions from Hyderabad, Pune, and Chennai.

Retail Real Estate

The retail subsegment of Indian real estate is thriving due to economic growth.

Key players in the nation’s mall development arena viz. DLF, Prestige and Phoenix are aggressively pursuing expansion. This surge in capital allocations aligns with the expansion strategies adopted by leading retailers, resulting in a substantial uptick in store numbers.

Rentals are expected to firm up, as economic buoyancy and robust consumer sentiment have led to healthy demand and trading densities for retail assets.

Warehousing

The warehousing sector showed resilience with consistent uptake in 9M FY24, driven by increased demand due to government initiatives such as the PLI scheme, and the global shift towards the China+1 policy.

While MMR maintained balanced supply and demand, NCR saw higher vacancies as demand softened even as new supply hit the market. The industrial sector outpaced logistics in uptake during Q2 and Q3 FY’24.

Tier II cities saw sustained institutional interest but lacked major product launches.

Rising construction and land acquisition costs caused an increase in rentals, except in oversupplied markets like NCR, where rates remained steady.

Entry yields for greenfield projects range from 9-10% p.a., while capitalization rates for stabilized assets fall within 7.5-8.25% p.a.

1

2

3

4

5

6