Riding high on consumer resurgence and quality real estate supply, the retail real estate is on upswing with 3.16 msf of gross leasing in top 7 cities. The existing retail stock, according to a JLL report, offers a potential of 43-44 msf of REIT-worthy retail assets. There is an expected supply pipeline of over 38 msf of retail developments between H2 2023 and 2027.

The operational retail stock as of H1 2023 in the top seven cities – Delhi NCR, Mumbai, Pune, Bengaluru, Kolkata, Chennai, and Hyderabad stands at 89 msf. . More than 50% of the current operational mall stock lies in Delhi NCR (28 million sq ft) and Mumbai (17 million sq ft). Mall completions of around 1.1 million sq ft were recorded in H1 2023, with additions in Hyderabad and Delhi NCR.

India’s retail sector is on an elevated growth curve where the focus is on creating an innovative built environment, greater connections with the consumers, and curating physical storefronts in untapped regions of the country including tier II and III cities. The shopping mall stock which stands at 89 million sq ft as of H1 2023 is expected to increase by around 43% to reach 127 million sq ft by the end of 2027. With India’s first retail REIT launched recently, the developers will focus on upgrading their retail assets by churning tenant mix, incorporating entertainment, leisure, and F&B avenues. Investments into new-age technology and improved user interfaces to appeal to a more tech-savvy, millennial generation are also being undertaken as part of a refreshed brand experience.

Gross leasing across the top seven cities (in shopping malls and leading high streets) stood at 3.16 million sq ft in H1 2023. Bengaluru led with a 34% share followed by Delhi NCR (23%) and Hyderabad (19%).

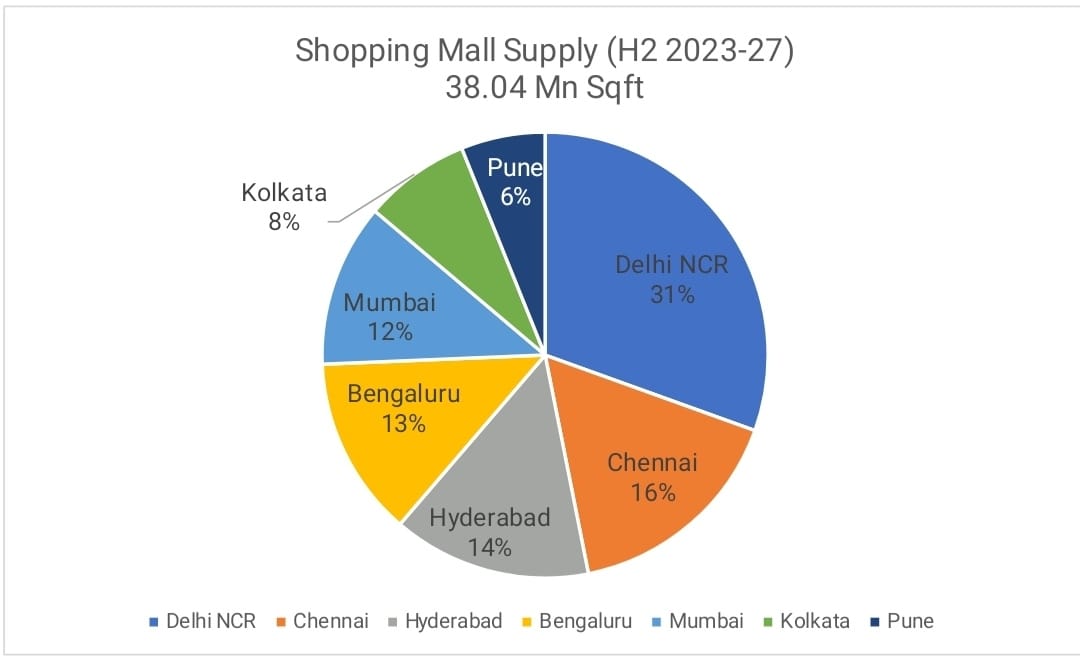

In a big boost to physical retail, prominent developers, global conglomerates, and institutional investors have been at the forefront of announcing and launching quality retail developments. The physical retail space segment has an expected supply pipeline of over 38 million sq ft of retail developments between H2 2023 and 2027, across the top seven cities. Delhi NCR is expected to lead in contribution towards upcoming mall supply with a 31% share, followed by Chennai (16%) and Hyderabad (14%). Around 18% of this approximately 6.7 msf of upcoming supply has institutional participation.

1

2

3

4

5

6