Residential Sales Value to Touch Rs 100,000 Crore in 2024

The residential sector is set to cross sales of 40000 housing units worth over Rs 95000 crore to Rs 100000 crore in 2024 with new planned upcoming supply and infrastructure development such as Dwarka Expressway and Noida International Airport.

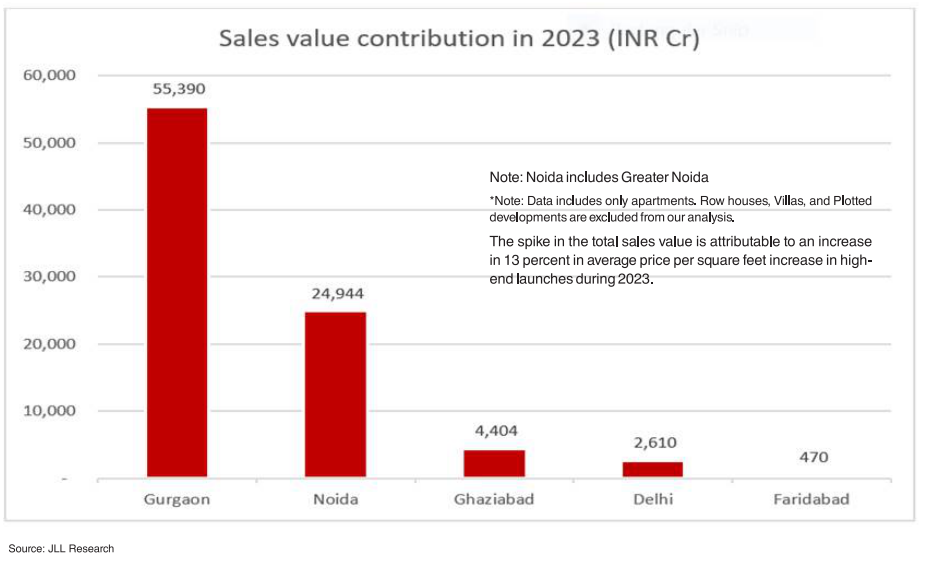

Gurgaon, with the highest share of 63 percent residential sales value at Rs 55390 crore, has emerged as a top driver of residential sales in Delhi-NCR, reaching Rs 88000 crore. in the calendar year 2023. Noida with a share of 28 percent recorded a sales value worth Rs 24944 crore.

Delhi NCR residential sector continued its growth momentum with total value of apartments sold at Rs 87,818 crore, up 23 percent Year-on-Year . This growth has been witnessed on the back of robust economic fundamentals, better job prospects with healthier income growth and addition of quality premium supply. The year 2023 also witnessed the average price per apartment in Delhi NCR touching Rs 2.29 crore, up from Rs 1.86 crore the previous year.

The residential sector is expected to cross 40,000 housing unit mark in 2024 worth over INR 95,000 crore to INR100,000 crore with new planned upcoming supply and infrastructure development such as Dwarka Expressway and Noida International Airport.

| Sales Value in 2023 | INR ~87,818 crore |

| Total sales value from new launches in 2023 priced 3 crore and above. | INR ~40,805 crore |

| Y-o-Y increase in sales value in 2023 | ~23%

|

Source: JLL Research

” Delhi- NCR, according to our analysis recorded a significant increase in total sales value in 2023 compared to the previous year due to increase in sales in the high-end segment. More than 46 percent of sales value contribution worth INR 40,805 crore was from new launches during the year and priced INR 3 crore and above. In 2023, a substantial proportion of new launches (42 percent) were in this price segment. It was seen that many luxury housing projects in Gurgaon and Noida were sold out within days of their launch” said Dr. Samantak Das, Chief Economist and Head Research & REIS, India, JLL.

The submarkets of Greater Noida and Ghaziabad known for their affordable housing have also witnessed luxury launches during the year, however, with limited number of units.

“While there have been substantial number of new launches in Delhi- NCR, the unsold inventory continued to decline to reach 66,777 units at the end of 2023, down by 19 percent compared to the previous year. It is also the lowest since 2009, indicating strong housing demand by end users as well as from investors. With RERA getting into action in a more intense way and government companies completing stuck projects, a total of 164,581 housing units were completed in 2023, the highest ever. Noida submarket alone witnessed 57 percent of the new completions this year,” said Ritesh Mehta, Senior Director-Residential, India, JLL.

In Gurgaon , the average price per apartment increased by 27 percent YoY to reach Rs 2.95 crore in 2023. Over the last couple of years, prices have seen a steep climb as reputed developers have added high end projects. The average price in Noida has reached Rs 1.68 crore compared to Rs 1.24 crore in 2022.

In Delhi NCR, Gurgaon was the preferred market in terms of sales value in 2023. This city witnessed highest share of around 63 percent in overall sales value at INR 55,390 crore and led in terms of number of units sold in Delhi- NCR. A total of 18,792 units were sold in Gurgaon in 2023 followed by Noida with a share of 28 percent in sales value at INR 24,944 crore.

Note: Noida includes Greater Noida

*Note: Data includes only apartments. Row houses, Villas, and Plotted developments are excluded from our analysis.

The spike in the total sales value is attributable to an increase in 13 percent in average price per square feet increase in high-end launches during 2023.

Record Home Completions Likely in 2024

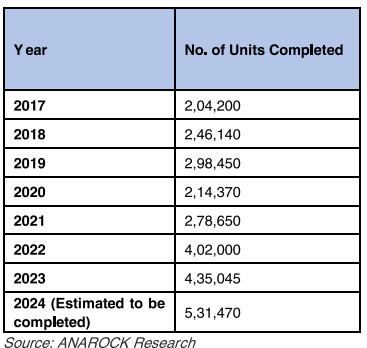

Riding high on the robust home completions last year, largely driven by MMR and NCR, the year 2024 is expected to witness record completion of 5.32 lakh housing units.

MMR & NCR together saw approximately 2,57,780 units completed in 2023 – MMR with about 1,43,500 units, followed by NCR with 1,14,280 units. In 2022, both these realty hotspots saw nearly 2,13,020 units completed, registering a 21 percent yearly growth in number of completed units. Bengaluru, Hyderabad, & Chennai together saw about 87,190 units completed in 2023 ..Pune saw about 65,000 units completed in 2023 – the only city where a lower number of units were completed in 2023 against 2022. As many as 5.32 lakh units are lined up for completion in 2024 across the top 7 cities. If construction goes as per schedule, MMR will again see highest completions of approximately 1.61 lakh units.

The year 2023 was a remarkable year for the Indian housing sector, with record high sales and new launches across the top 7 cities. Latest research data reveals that unit completions between 2017 and 2023 have not lagged this trend. Nearly 4.35 lakh homes were completed in 2023 across the top 7 cities – 8 percent higher than in 2022, when about. 4.02 lakh homes were completed.

According to Anuj Puri, Chairman, of Anarock Group, the robust sales along with RERA-related commitments have encouraged developers to stay focused on completing existing inventory. “If we consider the period between 2017 and 2023, the year 2023 saw the maximum annual unit completions, with over 4.35 lakh homes gaining RTM status across the top 7 cities.More than 5.31 lakh units are scheduled to be completed across the top 7 cities in 2024. says Puri. With housing demand remaining high, developers are prioritizing project completions. Moreover, many large developers have also taken up the task of completing many stuck or completely stalled projects of other players. They are now also committed to completing their own previously launched projects before launching new ones.”

After a phenomenal housing project completion rate in 2023, the year 2024 is on course to continue the trend, provided no major headwinds obstruct construction activities. Without such impediments, 2024 can well distinguish itself as the year of ready-to-move homes – and MMR is slated to see the highest number of this supply.

In MMR, approximately 160900 units are expected to be completed by the end of 2024.

In MMR, approximately 160900 units are expected to be completed by the end of 2024.

1

2

3

4

5

6