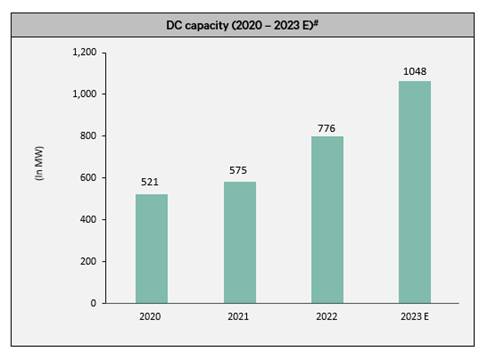

With nearly 500 MW currently under construction across several cities, Data Centre capacity is expected to touch 1048 MW by the end of 2023 and top 1300 MW by the end of 2024. Mumbai, Delhi-NCR, and Chennai dominate data centers stock with 80 percent combined share.

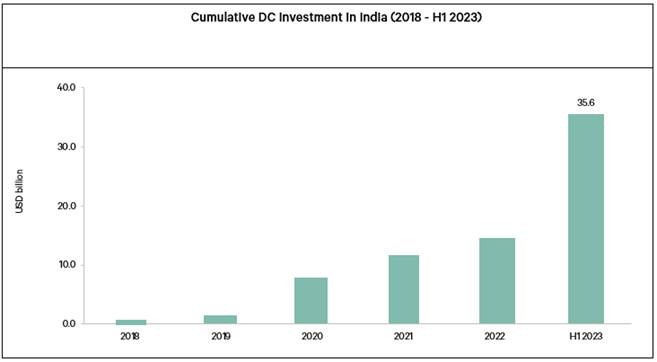

According to the Colliers report, aligning with the country’s progressive digital landscape, the Indian DC industry is witnessing a continuous uptrend owing to rapid digitalization, enhanced tech infrastructure, and the inclusion of advanced technologies such as 5G, Artificial Intelligence (AI), blockchain, and cloud computing.

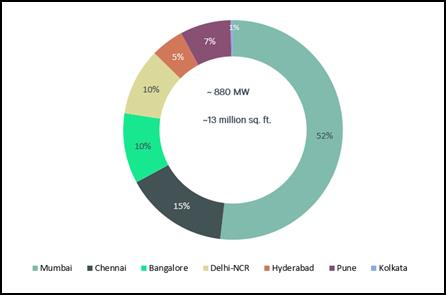

As per the report, India’s DC capacity has doubled over the last four-five years to reach 880 MW as of June 2023 and is expected to increase further to touch 1,048 MW by the end of 2023. During Jan-Jun 2023, the DC stock in the top 7 cities in India stood at 880 MW capacity spanning over 13 million sq. ft. Mumbai, Chennai, Bangalore, and Delhi-NCR accounted for about 87% of the country’s DC stock as of June 2023. Overall, DC occupancy levels in India stood at about 75 – 80 percent in Jan-Jun’23, which is likely to improve further by the end of the year.

Mumbai continues to be the most prominent DC market in the country, accounting for more than half of the total stock at 52 percent. The city is expected to lead the supply addition with a 46% share of the upcoming 500 MW by the end of 2024. The presence of multiple cable landing stations, inclusive government initiatives, and well-rooted entertainment and finance industries have established the city as a top destination for BFSI, media, cloud, and OTT companies to locate their DC operations. Chennai has also emerged as a key established tier 1-DC market in India, accounting for 21% of the total stock in the top 7 cities as of Jun’23. The city is expected to account for a 21% share of the upcoming 500 MW supply by the end of 2024. Until Jun’23, Bangalore and Delhi-NCR accounted for 10% of DC stock each.

According to Anshuman Magazine, Chairman & CEO – India, South-East Asia, Middle East & Africa, CBRE, heightened interest from investors looking to capitalize on DC’s attractiveness as a preferred alternate real estate option in the country is anticipated. Multiple state governments in India have been giving an enormous push to the DC segment in the country, with dedicated policies/incentives introduced to attract both global and domestic investors. Most of the states have also declared DCs under ‘essential services’ to ensure uninterrupted operations throughout the year. Ram Chandnani, Managing Director, Advisory & Transactions Services, CBRE India, says that technology companies, along with corporates from sectors such as BFSI, Cloud Services and OTT platforms will continue to drive DC demand in India. . Though the DC industry is witnessing an expansion in tier-I cities, leading hyperscalers and cloud service providers are also likely to expand to tier-II cities to capture the growing demand among BFSI firms and online streaming platforms to establish DC facilities closer to the consumption hubs.

Outlook for Data Centers

1

2

3

4

5

6