Mumbai and NCR have emerged as front runners in driving private equity investments in real estate. Though the investments have suffered an initial setback in the first half of the year, yet with the office sector taking the highest share of investments, a rebound is expected in the second half of 2023.

According to Knight Frank India’s latest report – ‘Trends in Private Equity Investment in India’, the real estate sector in India received $2.6 billion in private equity (PE) investments across office, warehousing and residential sectors in the first half of 2023. This is down 20% from H1 2022 as PE investors adopted a measured approach in H1 2023, resulting in a conservative shift in investment strategies. Despite prevailing global concerns influencing investments, the moderation in growth has been limited, and a rebound is anticipated in the second half of 2023. Overall, PE investments in the Indian real estate sector is estimated to touch $5.6 bn in 2023, a 5.3% YoY growth.

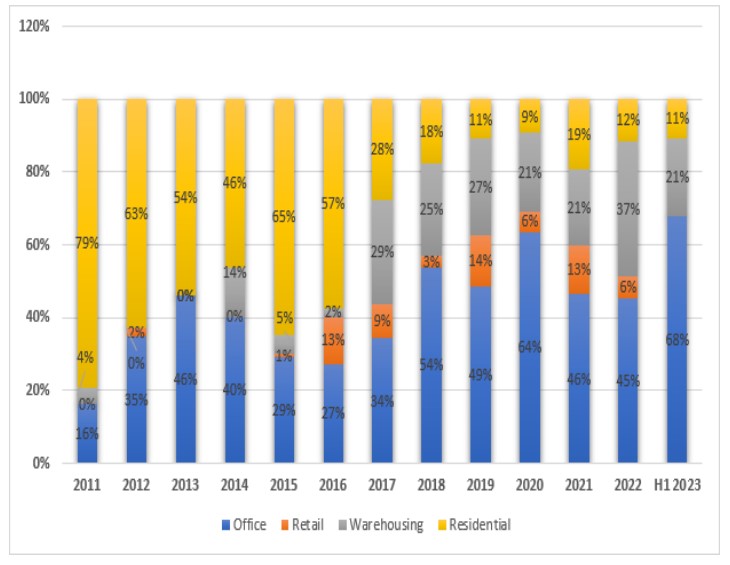

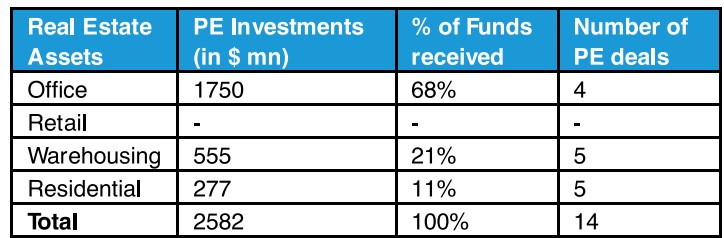

The office sector at 68% accounted for the largest share of all PE investments, followed by warehousing at 21% and residential at 11% share. Mumbai received highest investments accounting for 48%, NCR stood second at 32% and Bengaluru at 13%. Nearly 75% of investments came from Asian countries in H1 2023, in contrast to 86% investment received from Canada & US in H1 2022.

The office sector leads the pack in the market, warehousing in a strong second position

Source: Knight Frank Research, Venture Intelligence

The tightened lending standards and geopolitical uncertainty on a global scale kept investors cautious and limited their involvement in the market. Since March 2022, the US Federal Reserve has implemented interest rate hikes on ten occasions, resulting in a 2.25% point increase in rates, while the Central Bank of Canada has implemented nine such rate hikes, leading to a 2.75% point increase in the overnight rate. As a result, current interest rates in the US and Canada stand at 5.25% and 4.75% respectively, almost double compared to the pre-pandemic period. The impact of increased capital cost, and growing concerns of recession has subdued investment activity from these countries. In the first half of 2023, over 80% of the total investments were directed towards ready assets, clearly indicating investors’ cautious stance.

Segment wise break up of PE investments in H1 2023

Trends in PE investments in office segment

The office sector received $1.8 billion in investments during H1 2023. The trend of office assets maintaining their lead continued in H1 2023, accounting for a 68% share of total investments. The resilience of investable grade office assets supported this dominance. PE investments in the office sector experienced a YoY increase of 24% in H1 2023. This growth was largely driven by a substantial deal worth $1.4 bn between GIC and Brookfield India Real Estate Trust REIT. Around 80% of the investments in H1 2023 were in ready assets, while 20% were allocated to new and under-construction developments, reflecting investor aversion to risks. Mumbai, NCR and Bengaluru emerged as leading investment destinations for office investments in H1 2023.

Trends in PE investments in residential segment

Residential sector attracted $277 million in investments during H1 2023. All PE investments in the residential sector were focused on under-construction projects, aiming for investments at early stage for better returns. Foreign PE players accounted for 82% of the private equity investments in the residential sector. NCR and Bengaluru emerged as the leading investment destinations, driven by development stage transactions involving prominent global players.

Investor interest in retail moving beyond metros

Retail sector did not witness any deal in H1 2023. However, the listing of a retail REIT will likely lead to increased interest among investors. The investor interest in the retail sector has expanded beyond major metros during the last decade. Apart from the metros or the key 8 markets, the traction is also seen in markets like Chandigarh attracting investment of $267 mn, Nagpur and Amritsar $100 mn each, Indore $61 mn, and Bhubaneshwar $46 million. Investment platforms optimistic about growth prospects of the retail sector are expected to continue making capital commitments in the sector.

List of cities and amount of investment attracted in the past few years

Source: Knight Frank Research

Note: The Grand Total represents investments since 2011

Trends in PE investments in warehousing sector

Investment in the warehousing segment experienced a contraction in H1 2023, with an amount of $555 million compared to $1.2 billion in H1 2022. The lack of supply of high-quality grade assets contributed to the slowdown in investments in the warehousing sector. PE investors are targeting various sub-sectors within the warehousing market, including e-commerce logistics and 3PL (third-party logistics) facilities. Despite the dip in PE investment in warehousing in H1 2023, the outlook for this asset class remains positive. The demand for warehouse space is expected to continue growing in the coming years as E-commerce and logistics companies expand their operations. This is likely to drive an increase in PE investment in the warehousing sector in the future.

Equity remains the preferred investment route for investors

Nearly 96% of investors have taken the equity route to invest in H1 vs 60% in 2022, whereas 4% was via debt in H1 2023 vs 40% in 2022.

Source: Knight Frank Research, Venture Intelligence

According to Shishir Baijal, Chairman & Managing Director of Knight Frank, “Indian economic growth in the last few quarters has been a strong reason for long-term confidence among global investors. However, we have witnessed a decline in the volume of investments over the past year due to the economic challenges faced worldwide, leading some large economies to take drastic fiscal and monetary policy measures. This has further caused investors to re-evaluate their strategies, at least in the short-term. The India office sector continues to attract investors, particularly for ready income-yielding assets. Unlike other global gateway markets, India has consistently witnessed a steady growth momentum, which enhances investor confidence in the sector. Looking ahead, the office sector is expected to remain a favourite among investors, as it is likely to maintain its momentum in the short to mid-term.”

Outlook 2023

During the first half of 2023, the office segment remained the most favoured choice for investments, mainly due to the resilience displayed by high-quality office assets. While investments in other sectors experienced a slowdown, the underlying demand outlook for all sectors remains positive. Based on Knight Frank’s investment forecasting model, which considers factors such as government investment, currency fluctuations, inflation, interest rates, and office supply, it projects a YoY growth of 5.3% in PE investments in 2023, reaching USD 5.6 bn. The outlook for PE investment in office assets remains positive. As global headwinds subside, the resilience displayed by the Indian economy and the favourable unit economics of real estate assets will positively influence PE investment activity in the sector.

1

2

3

4

5

6