While tech firms saw a steep fall in occupier demand, engineering and manufacturing companies, ably supported by flex space segment, turned out to be the saviours amidst office segment witnessing rise in gross absorption in Q2 2023.

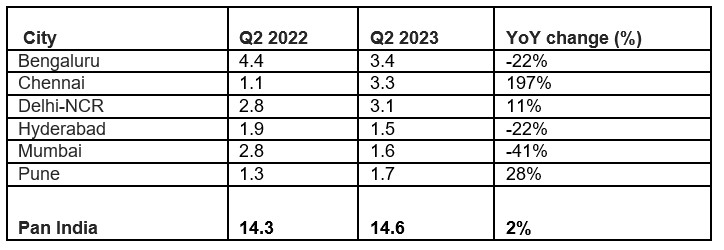

The second quarter of this year recorded 14.6 mn sq ft of gross absorption across the top 6 cities, rising by 2% YoY, making a strong comeback after a cautious first quarter. Amidst global economic headwinds, demand continued to grow on a sequential basis, indicating a continued occupier confidence. According to Colliers, Bengaluru and Chennai led the demand during Q2 2023, accounting for about half of the total leasing across top 6 cities. After witnessing lacklustre demand for the last few quarters, Chennai saw a three-fold rise in demand during Q2 2023 led by enhanced occupier activity.

Key Occupier Trends in Grade A Gross Absorption (in million sq feet)

Source: Colliers

Trends in Grade Agross absorption (in million sq. feet)

Source: Colliers

Technology and Engineering & Manufacturing sectors together dominated the office leasing activity in Q2 2023 contributing to 47% of the total leasing during the quarter. Leasing by Engineering and Manufacturing firms witnessed a three-fold rise YoY, as occupiers continued to take up larger spaces across top markets. Bengaluru and Chennai were the most preferred locations for engineering and manufacturing companies for their office expansions.

While the share of technology continued to dip from 40% in Q2 2022 to 26% in Q2 2023 amidst weak demand scenario, it remained dominant. At the same time, they continue to blend their real estate portfolio with flex as their core strategy, attracted by the flexibility, agility, and cost-effectiveness that they offer. Leasing by flex space surged 58% YoY during the quarter, as occupiers continued to adopt flex space as a long-term strategy.

With flex space continuing to gain larger ground, as occupiers focus on building operational efficiencies through a hybrid and distributed work model., the second half of 2023 is starting on a promising note with resurgence in demand across geographies., according to Peush Jain, Managing Director, Office Services, India, Colliers.

Rental trends Pan India

After witnessing subdued activity for last few quarters, Chennai saw heightened leasing activity during the quarter and accounted for about 23% of the total leasing in pan India, at par with Bengaluru. This surge can be attributed primarily to the growing demand from technology and engineering & manufacturing occupiers. The city is also seeing rising interest from flex operators, who are expanding their market coverage. Share of flex space in total leasing of the city surged to 19% in Q2 2023, from a mere 7% in Q2 2022.The new supply across the top 6 cities increased 32% YoY, at 12.4 mn sq ft, with Bengaluru contributing to 31% of the total new supply, followed by Hyderabad at 24% share. However, amidst robust supply, vacancy levels surged by 40 basis points (bps) on a YoY basis at 17.4%, as occupiers continue to consolidate their real estate portfolios to bring in cost and space efficiency while they adopt and build hybrid work models.

As the market stabilizes further with improved demand towards the latter part of the year, developers are likely to speed up their project completions. Amidst improving demand conditions supported by relevant market supply, vacancy levels are expected to remain rangebound & stabilize, with a potential upside on rentals by the end of the year., avers Vimal Nadar, Senior Director and Head of Research, Colliers India.

1

2

3

4

5

6